Your monthly UK housing market update. Covering sold prices, asking prices, surveyor sentiment and what’s next for the property market.

More homes, more movement. Buyers are back, but playing it smart.

HM Land Registry – Sold Prices

House prices crept up again in June, with annual inflation rising to 3.7%, up from 2.7% the month before.

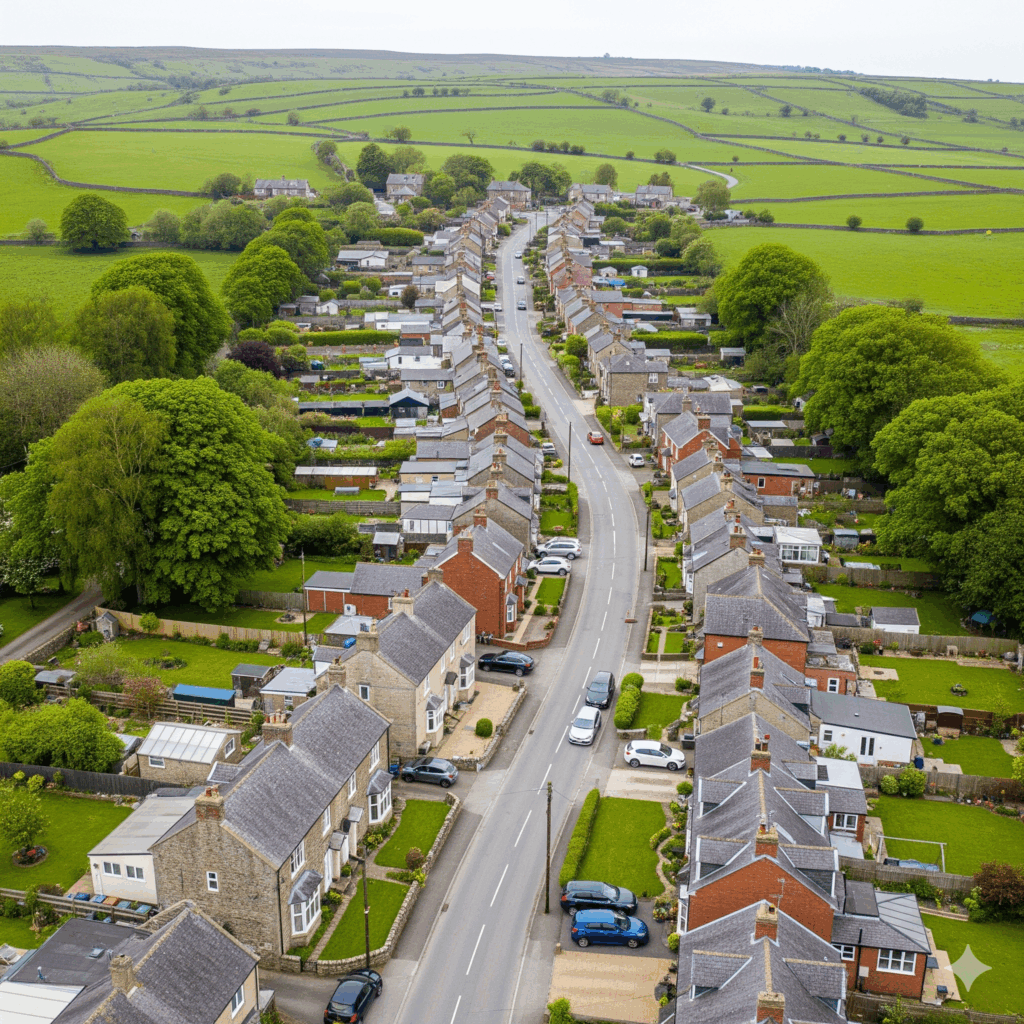

The average UK home now costs £269,000 (£9,000 more than last year). Scotland and Northern Ireland continue to show the strongest growth, with prices rising by 5.9% and 5.5% respectively. England saw a modest increase of 3.3%, while Wales was slightly lower at 2.6%. Within England, the North East led the way with a 7.8% rise. London lagged behind, managing just 0.8%.

Sales activity is also picking up pace. HMRC recorded 94,000 property transactions in June, up 13.4% compared to May. The bounce was strongest in England and Northern Ireland, although Scotland saw a small dip.

Meanwhile, mortgage approvals rose to 64,200, marking the second consecutive monthly increase. Buyers may still be cautious, but signs suggest confidence is returning, particularly outside of the South.

Rightmove – Asking Prices

Sellers continued sharpening their pricing strategies in July, creating the busiest summer for sales since the post-lockdown boom of 2020. The average asking price dropped by 1.3% this month, down to £368,740. It’s the third monthly fall in a row, but well within normal summer patterns—and behind it lies a steady uptick in market activity.

Agreed sales are now 8% higher than this time last year, thanks to realistic pricing and better affordability. The number of homes on the market is also 10% higher than last summer, keeping annual price growth modest at just 0.3%.

A third Bank of England rate cut has also given buyers a boost: the average two-year fixed mortgage rate now sits at 4.49%, down from 5.17% a year ago.

That said, the market remains two-speed. Well-priced homes are selling fast (average: 32 days), but overpriced listings (needing a price reduction) sit for 99 days on average.

RICS – Chartered Surveyor Sentiment

After hints of recovery earlier in the summer, surveyor confidence has taken a step back.

July’s RICS survey showed buyer demand and agreed sales slipping back into negative territory. New buyer enquiries recorded a net balance of -6% (down from +4% in June), while agreed sales fell to -16% (from -4% the month before).

The near-term outlook for sales is broadly flat, with just +1% of surveyors expecting activity to pick up over the next three months. At the 12-month horizon, the picture is slightly more optimistic (+8%), but not as strong as it was earlier in the year.

On pricing, the national balance now sits at -13%, down from -7% in previous months. Still, not all regions are moving in the same direction—prices continue rising in Scotland, Northern Ireland and parts of the North West, while East Anglia saw significant falls.

Looking ahead, 19% of surveyors expect price rises over the next year, but this is the lowest level since early 2024.

Zoopla – Housing Market Outlook

The housing market continues to see steady interest, with more people looking to move this year. But with more properties available than this time last year, buyers now have plenty of choice—especially in local areas where listings have surged. That means sellers need to be realistic. Overpricing could lead to long delays or no sale at all, while competitively priced homes attract solid interest.

There’s also been some media speculation about possible property tax changes, which may be making higher-value buyers a little more cautious. But for now, it’s just talk, and activity remains strong.

Looking ahead, Zoopla expects UK house prices to rise modestly by 1.5-2% over the rest of 2025. Southern England is showing early signs of price recovery, while growth appears to be slowing in the North.

Overall, the market remains on track for 5% more home sales this year—keeping momentum without overheating.

Express Index

For a full, comprehensive breakdown of current property market activity. Visit our Express Index here

Are you thinking of putting your home on the market?

We specialise in helping you get more for your property. Quicker, easier and with less stress.

You can call us any time on 0333 016 5458 where we can provide help, guidance and support.

Instant valuation – get a free 32-page instant valuation report here